INTEGRATIONS

Connect the necessary applications,

messengers and services so as not to miss a single customer request

Advantages

All the necessary tools in one system

Clear documentation on CRM integration

Easy initial setup

Fast connector deployment

Support and expansion of connector functionality

Functional capabilities

Features of the connector

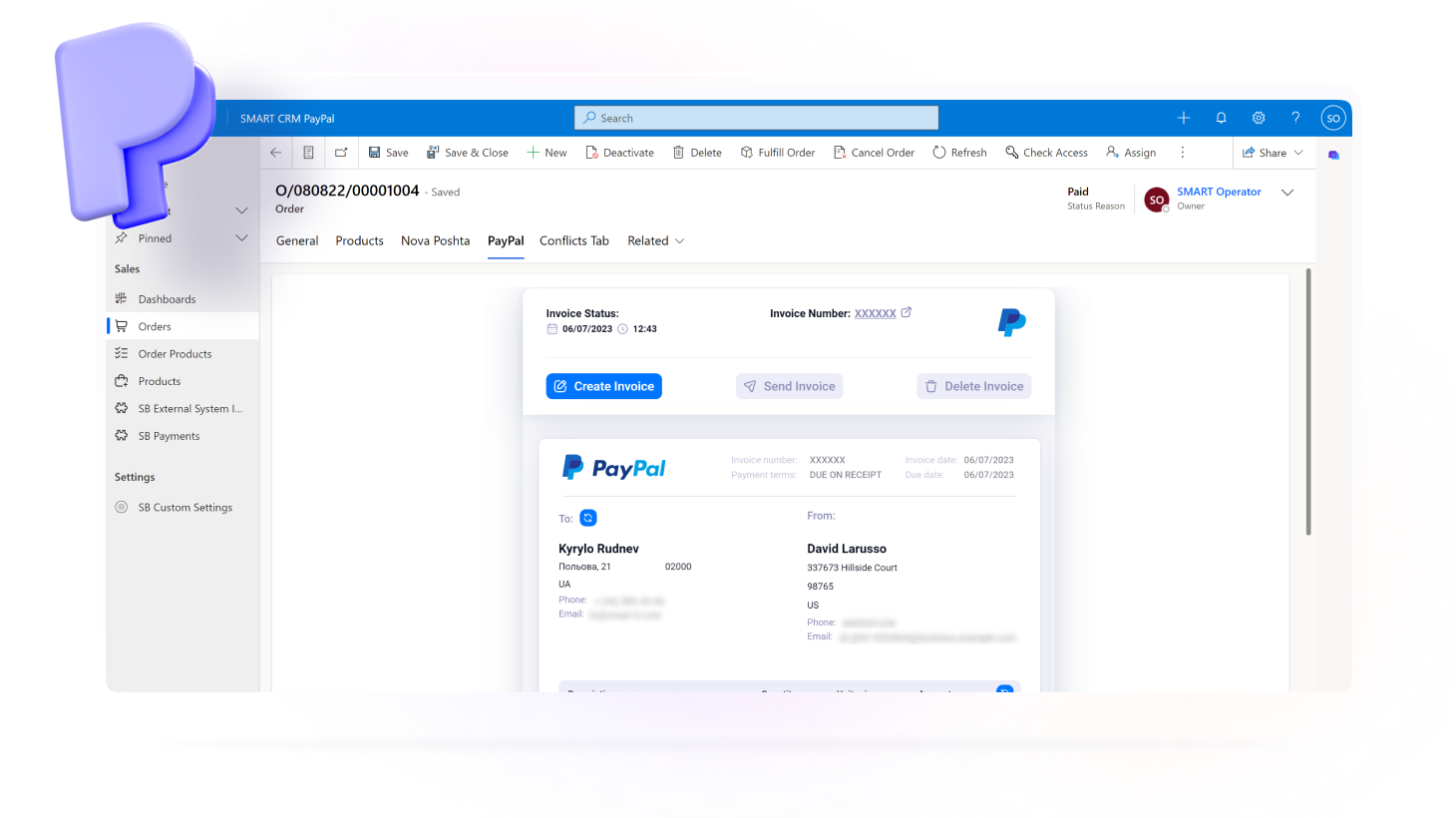

SMART Connector for PayPal

Connector for API of PayPal provides the ability to create a PayPal invoice for payment by the customer directly during the order processing. Regular synchronization of payment statuses and clear analytics allow you to track changes and respond to them in timely manner

I want a demo

Features of the connector

- An invoice is generated, created, deleted or cancelled directly from the SMART CRM or Microsoft Dynamics 365 interface

- Automatic calculation of the invoice amount depending on the products

- Automatic sending of an invoice for payment to the customer

- Printing out an invoice

- Ability to connect to any table in your system

- Regular automatic receipt of payment statuses

- Analysis of generated invoices and their statuses on Analytical dashboards

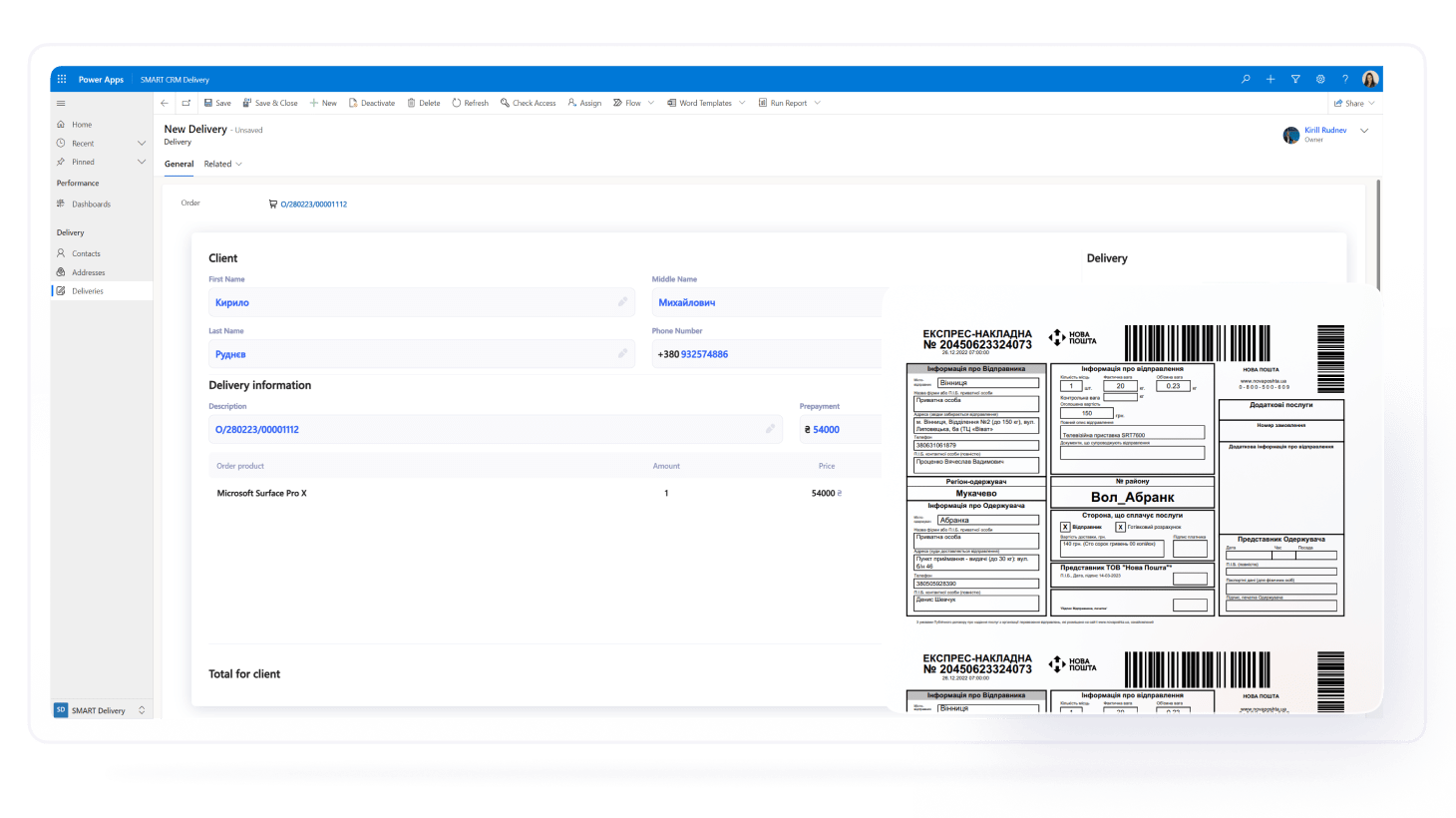

SMART Connector for Nova Poshta

Connector for API of Nova Poshta that provides the ability to create a waybill for shipment to a branch or address shipment directly during order processing in CRM, with subsequent synchronization of the shipment status

I want a demo

Features of the connector

- Shipment of parcels is generated, created, deleted or cancelled directly from the SMART CRM or Microsoft Dynamics 365 interface

- Senders management and creation of standard templates for different parcel sizes

- Printing out waybills in various formats

- Generatng and filling of registers of NP shipments from the SMART CRM or Microsoft Dynamics 365 interface

- Regular automatic receipt of the shipment status from the provider.

- Possibility to generate both address shipment and shipment to the branch

- Analysis of generated shipments on Analytical dashboards

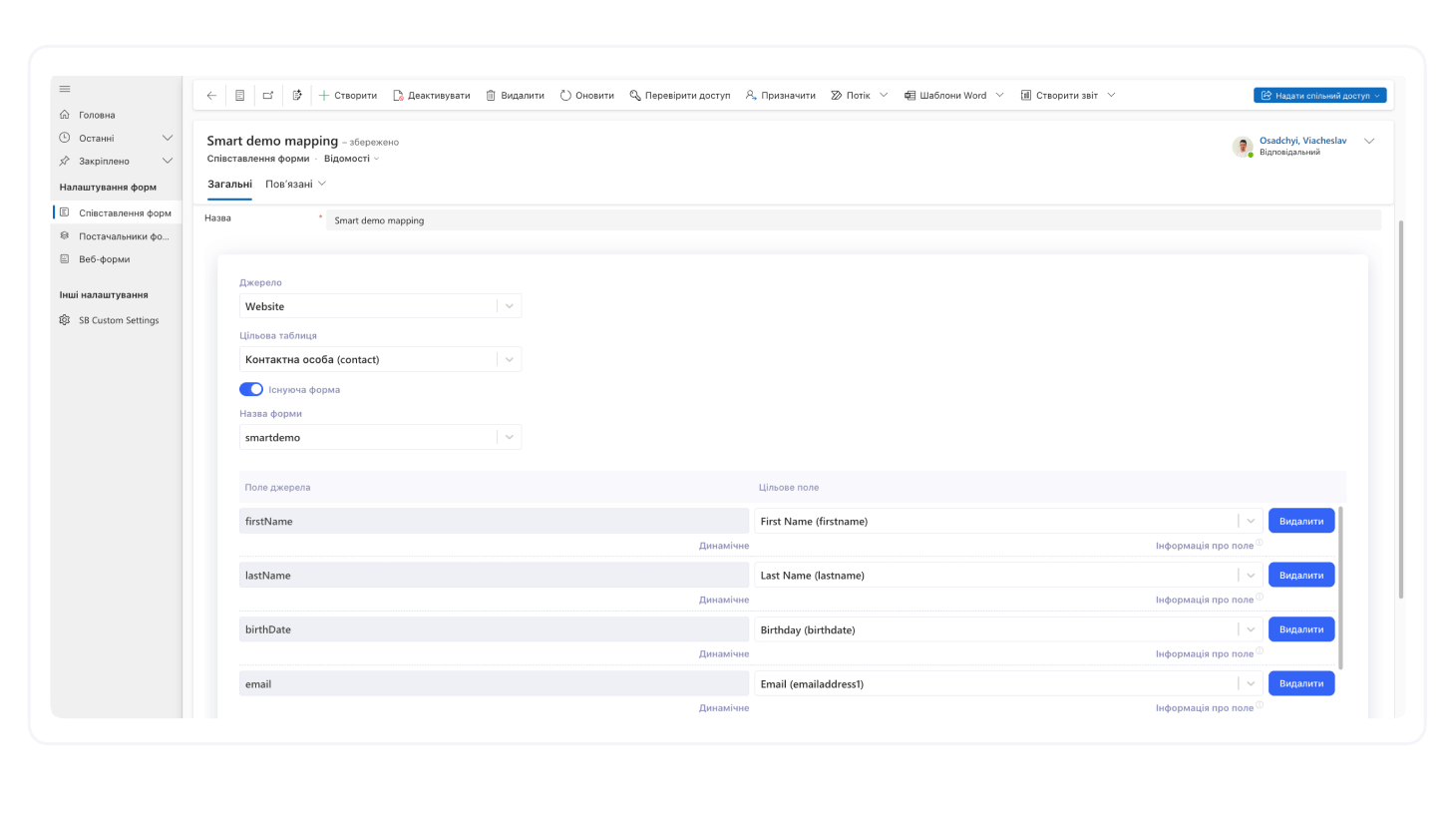

SMART Connector for Forms

A connector for configuring feedback and web forms directly in SMART CRM or any Power Platform–based solution. All information submitted through the form is instantly synchronized with the CRM.

Request a demo

Features of the connector

- Quickly connect website forms to your CRM or any Power Platform solution.

- Automatically save web form data to the CRM in real time.

- Connect as many forms as needed for different purposes (leads, inquiries, requests, applications, etc.).

- Use an intuitive visual tool to map form fields to CRM fields with ease.

- Support for multilingual form interfaces.

- Scalable design — compatible with any tables, including custom ones.

SMART Connector for Ringostat

API connector for Ringostat that provides the ability to receive incoming calls and make outgoing calls from SMART CRM

I want a demo

Features of the connector

- Automatic call creation. During a conversation with a client, the system automatically creates a call in SMART CRM or Dynamics 365 Sales/Customer Service, ensuring data synchronization.

- Ability to listen to calls. Recordings of all conversations are available for listening in the system, allowing you to listen to calls to improve the quality of service and train employees.

- Automation of communication processes. All incoming and outgoing calls will be automatically registered in the system, which significantly reduces manual work and minimizes errors.

- Automatic identification of clients. The system automatically identifies clients by phone numbers, and if the client is not in the database, it creates a new contact automatically.

- Updating statuses and call information. The system automatically updates call statuses and adds detailed information after the call is completed, which allows you to always be aware of the latest events.

- Simplified telephony. Easy and convenient management of incoming and outgoing calls significantly increases productivity.

- Saving the entire history of communications. The entire history of interactions with clients is saved on the contact timeline, which provides a complete overview of all interactions.

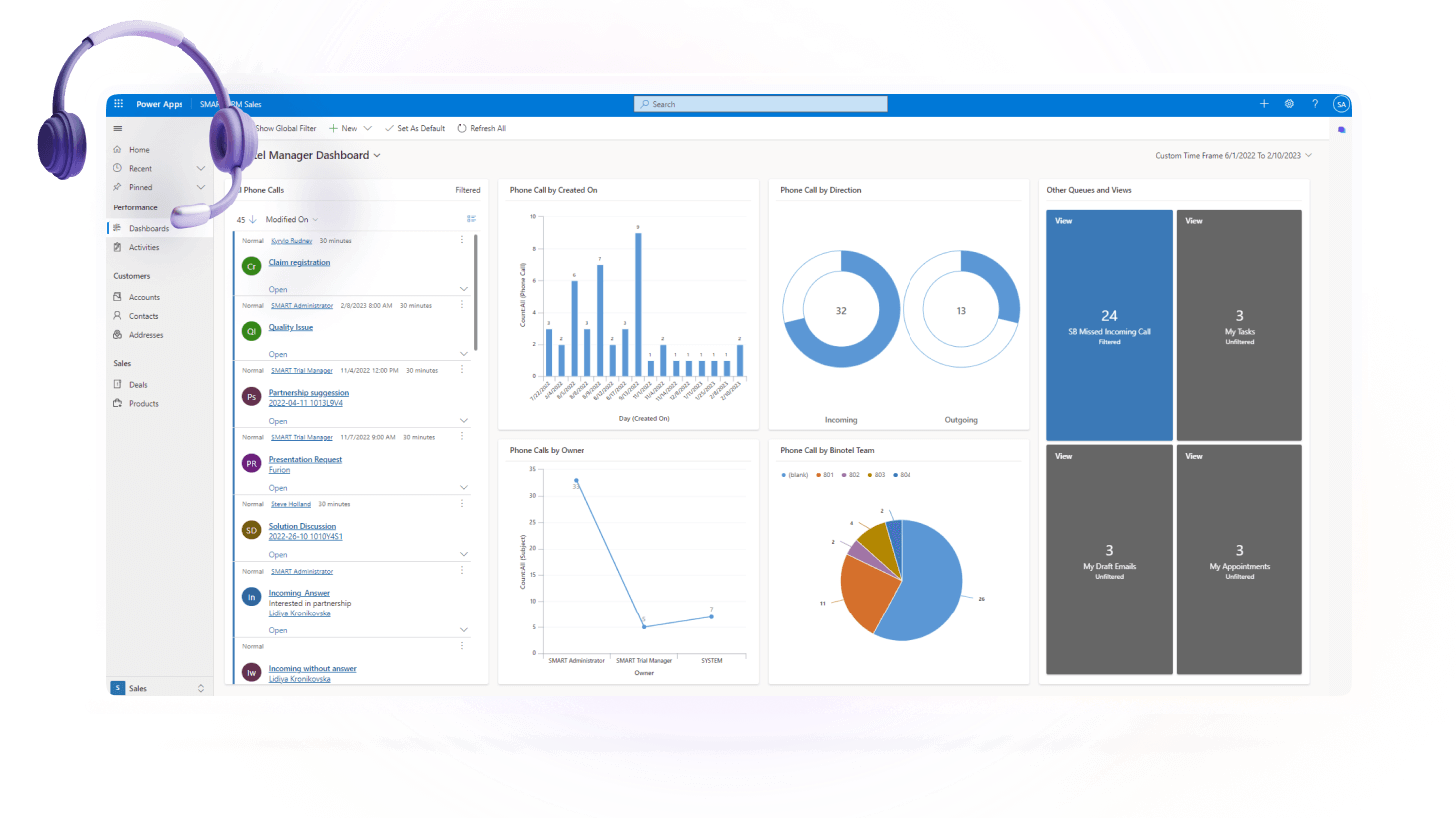

SMART Connector for Binotel

Connector for API of the Binotel IP telephony provider with the ability to receive incoming calls and make outgoing calls from SMART CRM, Dynamics 365, Power Platform

I want a demo

Features of the connector

- Automatic identification of the customer, taking into account the implementation of various scenarios for incoming calls: a customer with this phone number was not found; more than one customer with this phone number was found; customer is identified

- Automatic creation of a contact / interest card during an incoming call if the customer is calling for the first time

- Viewing the necessary information about the identified customer directly in the call card

- Forwarding to another operator while saving the history of switching and the duration of each phase of the call

- Recording of all missed calls for quick processing

- Web notification of an incoming call even when the browser window is minimized

- Collection and analysis of calls by days, operators, groups and directions

- Ability to independently select tables and fields with a phone number to initiate a quick outgoing call in one click from the SMART CRM/Dynamics 365/Power Apps interface

- Listening to the history of all conversations directly from the call card from the SMART CRM/Dynamics 365/Power Apps interface

PRICING

Select your plan

SMART Connector for

Telephony (Binotel)*

$

150 .00

for the use of the environment per month

API connector for Binotel IP telephony that provides the ability to receive incoming calls and make outgoing calls from SMART CRM

SMART Connector for

Telephony (Ringostat)*

$

150 .00

for the use of the environment per month

API connector for Ringostat IP telephony that provides the ability to receive incoming calls and make outgoing calls from SMART CRM

SMART Connector for

Telephony (Stream Telecom)*

$

150 .00

for the use of the environment per month

Connector to the API of the Stream Telecom IP telephony provider that enables receiving incoming calls and making outgoing calls directly from SMART CRM.

SMART Connector for

eSputnik*

$

100 .00

for the use of the environment per month

API connector for eSputnik that provides the ability to configure and send email newsletters

SMART Connector for

GMS*

$

100 .00

for the use of the environment per month

API connector for GMS Ukraine to set up and send newsletters via SMS/Viber

SMART Connector for

Infobip*

$

100 .00

for the use of the environment per month

API connector for Infobip to set up and send newsletters via SMS/Viber

SMART Connector for

PayPal*

$

100 .00

for the use of the environment per month

API connector for PayPal to create an invoice and provide the client with the ability to pay for it when ordering

SMART Connector for

UAPAY*

$

100 .00

for the use of the environment per month

Connector to the UAPAY service API that enables the creation of a payment invoice for the customer directly during order processing.

SMART Connector for

Monopay*

$

100 .00

for the use of the environment per month

Connector to the monobank service API that enables the creation of a payment invoice for the customer directly during order processing.

SMART Connector for

Przelewy24*

$

100 .00

for the use of the environment per month

Connector to the API of the Polish Przelewy24 service for creating and allowing customers to pay invoices directly at the time of order.

SMART Connector for

Rozetka

$

150 .00

for the use of the environment per month

A connector that enables processing of orders from the Rozetka marketplace directly in the SMART CRM or Microsoft Dynamics 365 interface.

SMART Connector for

Nova Poshta

$

150 .00

for the use of the environment per month

API connector for Nova Poshta to create a waybill and send it directly when processing an order in CRM

SMART Connector for

Ukrposhta

$

150 .00

for the use of the environment per month

API connector for Ukrposhta to create a waybill and send it directly when processing an order in CRM

SMART Connector for

Forms

$

200 .00

for the use of the environment per month

A connector for configuring feedback and web forms directly in SMART CRM or any Power Platform–based solution. All information submitted through the form is instantly synchronized with the CRM

SMART Connector for

InPost

$

150 .00

for the use of the environment per month

A connector to the Polish delivery service InPost, enabling the creation of shipping waybills for customer orders directly during processing in the CRM

*The price is indicated per connector. Use of Microsoft Azure resources is required for the operation of connectors and modules.

FEEDBACK

Our goal is your business result

Choose tools to meet your customers' expectations before they become challenges.

We are trusted

Blog

Articles and materials

January 28th, 2026

21 min read

How Aqua Plus Doubled Its Customer Base in Just 2 Years — and the Role of CRM

January 28th, 2026

2 min read

SMART Customer Survey: A Convenient Module for Collecting Feedback in CRM

January 20th, 2026

20 min read

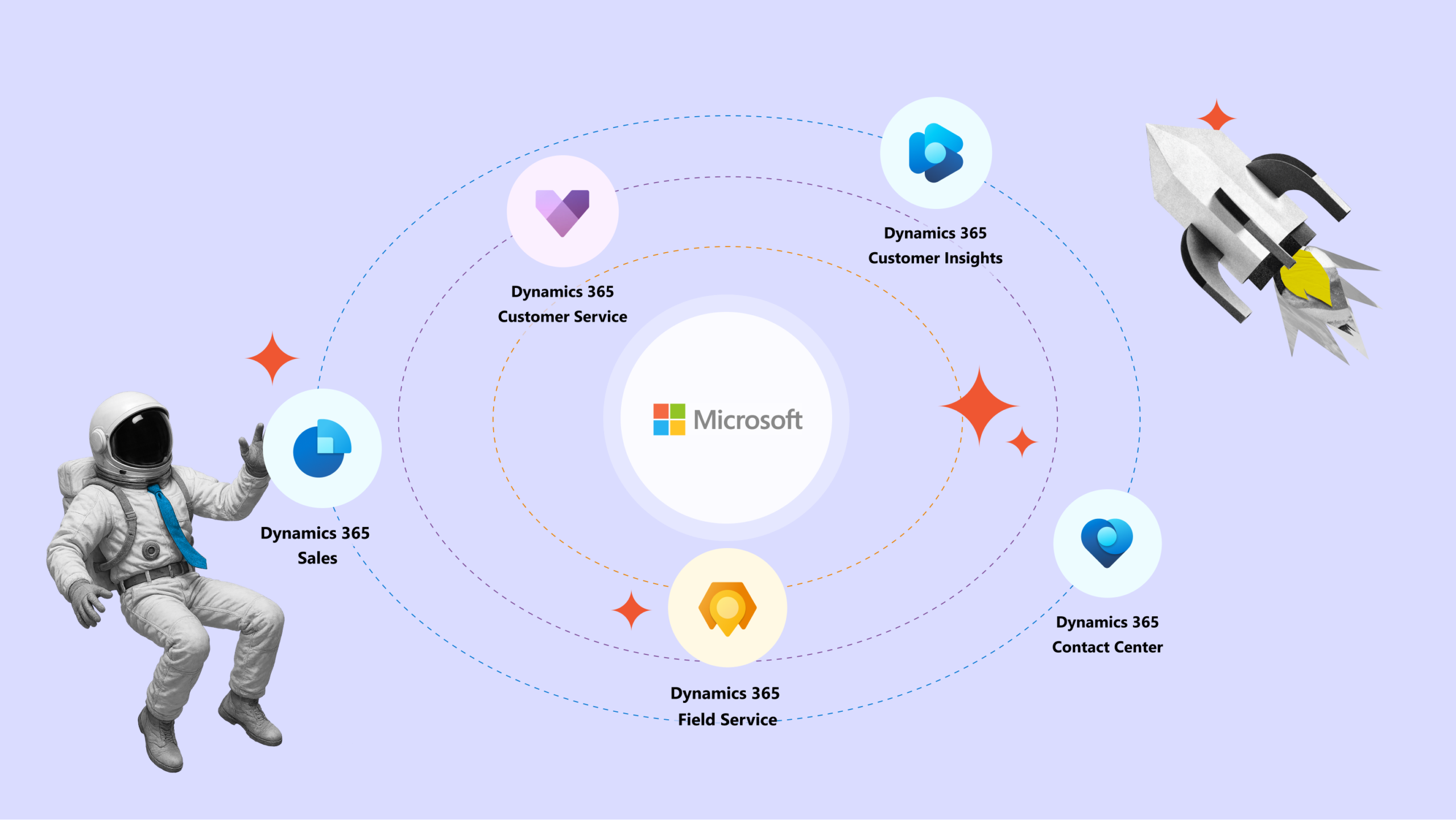

The Microsoft Dynamics CRM Ecosystem: What It Includes and How It Works